Test Owner

Between 2025 and early 2026, Saab reached a series of landmark achievements in integrating artificial intelligence into its Gripen E fighter jet. Central to this progress was Saab’s close collaboration with Helsing, a German defense technology firm specializing in advanced AI systems.

A Major AI Breakthrough: Project Beyond

In mid-2025, Saab and Helsing successfully concluded the first-ever live flight tests in which an AI agent, named Centaur, assumed full control of a production-standard Gripen E during air combat maneuvers. Conducted under Project Beyond, these tests marked a historic step toward operational autonomous combat aviation.

Live Combat Simulations over the Baltic Sea

During flight trials on May 28 and June 3, 2025, over the Baltic Sea, Centaur autonomously carried out Beyond Visual Range (BVR) combat scenarios against a human-piloted Gripen D. The AI demonstrated the ability to detect, track, and respond to threats without direct human input, highlighting its potential role in future air combat environments.

Human–Machine Teaming in the Cockpit

Although a safety pilot remained onboard, Centaur processed sensor data in real time to plan tactical maneuvers, evade simulated threats, and generate missile-firing cues. This setup showcased a new level of pilot–AI collaboration, where the AI acted as both tactician and decision-support system rather than a simple automation tool.

Rapid Development through Self-Learning

One of the most striking aspects of the program was its speed. The AI system was integrated and flight-tested in less than six months. Centaur was trained primarily through self-play in advanced simulators, where it competed against itself and accumulated the equivalent of nearly 50 years of flight experience in only a few days.

Strategic Advancements Shaping 2025–2026

Software-Defined Combat Edge

Project Beyond reflects Saab’s philosophy of “no generations, only speed.” Leveraging the Gripen E’s modular, software-defined architecture, new capabilities can be deployed in days rather than years.

Path to Future Fighters

The trials directly support Sweden’s Future Fighter Concept Studies, contributing data and insights for the development of next-generation crewed and uncrewed combat aircraft planned for the 2030s and beyond.

International Sales and Interoperability

In late 2025, Saab secured major Gripen E/F export contracts, including 17 aircraft for Colombia and additional orders from Thailand. Saab also continued marketing the Gripen E as a “fifth-generation technology” solution for the Indian Air Force’s MRFA program.

AI-Driven Electronic Warfare

In December 2025, Saab and Helsing received orders to equip German Eurofighter aircraft with the Arexis Electronic Warfare suite, incorporating AI technologies developed through their strategic partnership.

Status as of January 2026

By early January 2026, Sweden’s Defence Materiel Administration (FMV) continued funding Gripen development to ensure the platform remains a cornerstone for future autonomous combat capabilities. Ongoing analysis of data gathered during the 2025 flight tests is now being used to further refine Centaur, with a particular focus on complex multi-aircraft and cooperative combat scenarios.

China’s commercial aerospace industry is entering a critical phase in 2025—marked by rapid expansion, government-backed innovation, and ambitious domestic programs. Yet, the sector also faces mounting pressure from geopolitical tensions, global competition, and technological dependencies.

Market Snapshot: Strong Growth Across Segments

Commercial Aircraft: Revenue is projected to reach $12.52 billion in 2025, supported by 177 aircraft deliveries.

Commercial Space: The market is expected to surpass 2.5 trillion yuan, as Beijing promotes the “safe and healthy development” of private and state-owned ventures.

MRO Services: The aerospace maintenance, repair, and overhaul (MRO) market is set for sustained growth, with a CAGR of 11.62% (2025–2035), driven by expanding and aging fleets.

Key Growth Drivers

Government Support: Policies like Made in China 2025 and the inclusion of “commercial space” in national plans reinforce state investment and localized manufacturing, pushing foreign suppliers to adapt to domestic sourcing rules.

Commercial Space Expansion: China’s private and state enterprises are achieving milestones in reusable rocketsand commercial satellite launches, building a complete, self-reliant ecosystem.

Surging Air Travel Demand: Despite slower GDP growth, China is on track to become the world’s largest air travel market by 2043, sustaining demand for new aircraft and MRO capacity.

State-Private Synergy: The “dual-engine model”—state-owned firms providing scale and private firms driving innovation—remains a core strength of China’s aerospace strategy.

Challenges: Supply Chains, Certification, and Competition

C919 Delays: COMAC’s C919 jet continues to face production bottlenecks, supply chain disruptions, and a lack of international certification—limiting access to Western markets until at least 2028.

Foreign Dependence: Heavy reliance on Western components, especially engines, exposes production to export controls and trade restrictions.

Geopolitical Friction: Ongoing U.S.–China tensions—including export bans and tariffs—have complicated supply chains and raised production costs.

Competitive Pressure: Airbus and Boeing remain dominant, with Airbus expanding local operations in Tianjin. Meanwhile, China’s push for self-sufficiency adds complexity for foreign suppliers navigating IP and compliance risks.

Outlook: Ambitious but Tested

China’s aerospace sector is growing on two powerful fronts—commercial aviation and space—supported by policy, investment, and a massive domestic market. The C919’s progress remains a bellwether of China’s technological independence, while commercial space ventures reflect its ambition to become a global leader in next-generation aerospace innovation.

However, success will hinge on balancing self-reliance and global collaboration, managing supply chain resilience, and achieving regulatory milestones. If China can overcome these challenges, 2025 could mark the beginning of its transition from fast follower to formidable aerospace powerhouse.

The global aerospace and defense (A&D) sector is at an inflection point. On one hand, the industry is experiencing strong growth: Airbus and Boeing forecast more than 40,000 new aircraft will be built over the next two decades, while defense spending surged nearly 10% in 2024 — the sharpest increase in nearly forty years. On the other hand, the sector faces seismic disruption.

Geopolitical instability, fractured supply chains, sustainability pressures, and the rapid acceleration of digital technologies are reshaping the rules of the game. Traditional strategies are no longer enough. To succeed, A&D leaders must act with greater agility, innovation, and foresight than ever before.

Ten Forces Reshaping the Industry

Supply Chain Resilience – After years of globalization, A&D players are now prioritizing resilience. Nearshoring, diversification, and the use of AI, blockchain, and digital twins are becoming essential to monitor risk, ensure continuity, and meet sovereign security demands.

Next-Gen Competition – Barriers to entry are falling. Startups and SMEs, backed by record private capital, are scaling fast with additive manufacturing, dual-use technologies, and software-driven platforms. Agile disruptors are challenging incumbents for government and commercial contracts.

Digitalization – Decision-making speed is now a decisive advantage. Organizations are embedding AI, advanced analytics, and automation to enhance operations, streamline procurement, and deliver faster to the field. Those who fail to digitalize risk falling behind.

Workforce Transformation – Talent shortages have become a strategic risk. With over 40% of A&D executives reporting challenges in attracting skilled workers, companies must rethink hiring, invest in reskilling, and integrate workforce planning with business strategy.

The Space Economy – The commercialization of space is accelerating, from satellite networks to private launch services. This frontier presents opportunities for growth but requires new regulatory frameworks, public-private partnerships, and international collaboration.

Geopolitics – Trade wars, tariffs, and conflicts are forcing nations to prioritize industrial sovereignty. Shifts in alliances and export controls are rewiring global supply chains and investment flows, making geopolitics a central factor in corporate strategy.

R&D Innovation – Speed matters. Defense buyers are turning to “80% solutions” — adaptable, off-the-shelf systems that can be rapidly deployed — rather than waiting years for bespoke platforms. Software-defined defense and dual-use technologies are narrowing the gap between innovation and adoption.

Sustainability – Aviation and defense account for around 4% of global emissions. The challenge is delivering growth while reducing carbon intensity. Sustainable aviation fuels (SAF), circular manufacturing, and energy efficiency are advancing, but scaling solutions requires broad collaboration across governments and industry.

Strategic M&A – Consolidation is accelerating as players pursue scale, supply chain control, and innovation capabilities. Recent high-profile deals signal a wave of activity in subsectors such as drones, space systems, and cybersecurity.

Integrated Defense Domains – Future readiness depends on blending cyber, space, air, land, and sea operations. The integration of commercial and defense technologies is critical to achieving superiority in modern conflicts.

From Disruption to Leadership

What unites these trends is urgency. The pace of change is quickening, and hesitation carries real risk. The winners will be those who:

Embed resilience into supply chains and operations.

Accelerate digital adoption across the enterprise.

Invest in talent to build adaptable, tech-savvy workforces.

Pursue sustainability not as a compliance exercise but as a competitive differentiator.

Leverage partnerships and M&A to capture innovation at scale.

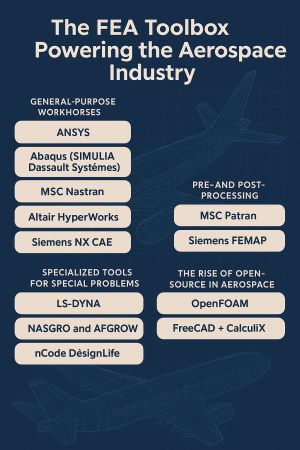

In the high-stakes world of aerospace engineering, every gram of weight and every fraction of a degree in temperature can make or break a design. Finite Element Analysis (FEA) has become one of the industry’s most important tools, allowing engineers to simulate, refine, and validate designs long before a single part is built. Today’s aerospace companies rely on a mix of powerful commercial suites, specialized solvers, and open-source tools to get the job done. From aircraft manufacturers like Boeing and Airbus to space players such as SpaceX and NASA, FEA is part of nearly every stage of development — from early concept models to flight certification.

General-Purpose Workhorses

For most structural and thermal simulations, engineers turn to full-featured commercial packages:

ANSYS is a favorite for its multiphysics capabilities, letting teams analyze fluid-structure interactions and thermal-stress coupling in complex systems like jet engines.

Abaqus (SIMULIA, Dassault Systèmes) shines in non-linear problems and composite material modeling, critical for spacecraft heat shields or satellite bus structures.

MSC Nastran, a NASA original, remains the industry benchmark for structural analysis, trusted for everything from wing deflection to satellite panel vibration.

Altair HyperWorks brings best-in-class meshing with HyperMesh and optimization capabilities with OptiStruct.

Siemens NX CAE integrates CAD, CAM, and CAE under one roof, letting teams design and simulate in the same environment — a major productivity boost.

Pre- and Post-Processing: The Unsung Heroes

Preparing a model for analysis is just as critical as solving it. Tools like MSC Patran and Siemens FEMAP are mainstays for setting up meshes, defining loads, and interpreting results, particularly when working alongside Nastran.

Specialized Tools for Special Problems

When projects demand extreme accuracy, engineers turn to niche software:

LS-DYNA for crash simulations, impact events, and “blade-out” scenarios.

NASGRO and AFGROW for fracture mechanics and fatigue crack growth, helping ensure structural safety over long service lives.

nCode DesignLife for predicting how components behave under countless stress cycles.

These programs help aerospace companies meet rigorous safety standards while minimizing costly physical testing.

The Rise of Open-Source in Aerospace

Even in an industry dominated by commercial software, open-source tools are gaining ground. OpenFOAM provides a powerful platform for CFD studies, and FreeCAD paired with CalculiX is finding a place in research labs and startups looking to experiment without heavy licensing costs.

FEA has evolved from a niche tool to an indispensable part of aerospace development. As aircraft become lighter, engines more efficient, and spacecraft more ambitious, the role of simulation will only grow. For engineers, mastering these tools isn’t just helpful — it’s essential.

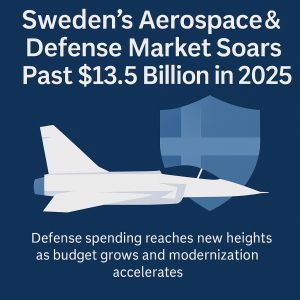

Sweden’s defense industry is entering its busiest decade in recent memory. In 2025, the country’s defense spending reached $13.5 billion, a 14.1% increase over 2024, marking the first time Sweden has exceeded NATO’s 2% GDP guideline — coming in at 2.3% of GDP.

This is more than just a budget figure. It signals a clear shift in Sweden’s role on the global stage. The increase follows Sweden’s formal accession to NATO earlier this year, a decision widely seen as a response to Russia’s ongoing war in Ukraine.

Modernization and Industry Impact

The bulk of this new funding is being directed toward modernization programs. Saab, Sweden’s largest defense company, is ramping up production of the Gripen E fighter jet for both domestic and export customers. Its 2024 first-quarter report showed 91% of total sales were defense-related, with strong performance in its Aeronautics and Surveillance divisions.

The Swedish Armed Forces have also announced procurement plans for new Patriot air defense systems, expanded radar and early-warning capabilities, and investments in cyber defense infrastructure. The navy is upgrading its submarine fleet, and the army is accelerating purchases of artillery and armored vehicles.

Looking Ahead

The growth isn’t stopping in 2025. The Swedish government’s 2026 budget bill, presented in September, adds another $2.87 billion (SEK 26.6 billion) to defense — an 18% jump — pushing spending to 2.8% of GDP. If approved, this would represent one of the largest year-over-year increases in Swedish defense history.

Market analysts expect a 6.7% compound annual growth rate (CAGR) for Sweden’s defense market from 2026 to 2030, fueled by multi-year NATO capability targets and a long pipeline of modernization projects.

Opportunities for Industry Players

The spending surge is a boon for aerospace and defense contractors. Saab is already hiring additional engineers for Gripen and radar programs. International firms like Raytheon, BAE Systems, and Thales are competing for contracts in missile defense, communications, and surveillance technology. Maintenance and support providers are also expected to benefit as the Swedish military expands its equipment inventory.

Why It Matters

For Sweden, this isn’t just about budgets — it’s about readiness. The country is building a modern, NATO-integrated defense force. For industry professionals and suppliers, this means years of project opportunities, from advanced fighter programs to cybersecurity solutions.

What is CATIA 3DX?

CATIA 3DX is the modern version of CATIA (Computer Aided Three-dimensional Interactive Application), now part of Dassault Systèmes’ 3DEXPERIENCE platform. It’s not just software — it’s a connected, cloud-enabled environment where designers, engineers, and manufacturers can work together on the same product in real time, no matter where they are in the world.

For companies in automotive and aerospace, this means faster innovation, fewer errors, and smoother collaboration between teams.

CATIA V5 vs. CATIA 3DX — The Big Shift

| Feature | CATIA V5 (Traditional) | CATIA 3DX (Modern) |

|---|---|---|

| Where it runs | Installed on a single computer, saving files locally. | Runs on a shared platform — can be cloud-based — so everyone sees the same data. |

| How data is handled | Engineers save separate files, which can get out of sync. | A single, central database keeps everything updated automatically. |

| Teamwork | Teams email files or use shared drives to collaborate. | Teams work on the same model at the same time, even from different continents. |

| Ease of use | A classic but older interface. | Modern, web-like interface that feels more intuitive. |

| Scalability | Requires heavy IT setup and maintenance. | Scales easily for growing teams with subscription-based access. |

In short, CATIA 3DX moves design from a file-based world to a collaborative, connected world.

Real-World Impact in Automotive

In the fast-paced automotive industry, speed and precision are critical. CATIA 3DX helps automakers:

Develop new models faster: Teams can design, test, and refine vehicle components in the same digital space, cutting down prototype costs.

Collaborate across suppliers: Whether a supplier is in Germany, Japan, or the U.S., they can work on the same virtual car in real time, avoiding delays and misunderstandings.

Support electric and autonomous vehicle innovation: CATIA 3DX integrates mechanical, electrical, and software systems, making it easier to design complex EV powertrains and ADAS (advanced driver-assistance systems).

For example, an electric car manufacturer can simulate battery placement, crash performance, and aerodynamics — all virtually — before ever building a physical prototype.

Real-World Impact in Aerospace

In aerospace, safety, complexity, and global collaboration make CATIA 3DX a game-changer. It enables:

Digital twin development: Engineers can create a “virtual twin” of an aircraft, testing everything from aerodynamics to wiring systems digitally before physical production.

Global collaboration: Aerospace programs involve hundreds of suppliers worldwide. CATIA 3DX keeps everyone connected to the same source of truth, preventing costly rework.

Regulatory compliance: The platform tracks design history and changes automatically, making audits and certification easier.

Imagine designing a new jetliner: thousands of parts, miles of wiring, and strict safety requirements. CATIA 3DX helps keep all that complexity organized, ensuring the final aircraft is safe and built right the first time.

Why It Matters

CATIA 3DX isn’t just for engineers — it connects the entire product lifecycle: from concept sketches to factory floor planning. The result is:

Faster time to market

Fewer mistakes and rework

Better collaboration between designers, suppliers, and manufacturers

Reduced costs thanks to virtual testing and fewer physical prototypes

For industries like automotive and aerospace, where innovation cycles are getting shorter and competition is fierce, CATIA 3DX provides a significant competitive advantage.

GKN Aerospace is accelerating its push toward more sustainable aviation with a £50 million (600 million SEK) investment in additive manufacturing at its facility in Trollhättan, Sweden. The move will establish a new Centre of Excellence dedicated to large-scale 3D printing of aircraft engine components, creating around 250 highly skilled jobs for engineers, operators, and technicians.

The Swedish Energy Agency, through its Industriklivet initiative, will contribute £12 million (152 million SEK) to the project, underscoring its national importance in driving innovation and reducing the climate footprint of aviation.

At the heart of the initiative is a fundamental shift in how aircraft components are produced. Traditional manufacturing relies heavily on large castings and forgings, where as much as 80% of the raw material is cut away during machining. By contrast, additive manufacturing builds components layer by layer, reducing raw material usage by up to 80% while simultaneously lowering production costs, cutting emissions, and speeding up delivery times.

The new Trollhättan facility will focus on developing and industrialising additive techniques for large, complex, and load-bearing engine parts. These components are critical to aircraft performance, and the ability to print them at scale represents a major technological milestone.

For GKN Aerospace, the investment is also a culmination of nearly two decades of research and development in 3D printing, with expertise already established in Sweden, the UK, and the US. The company sees the Trollhättan centre as a global reference point for advancing the technology and pushing the boundaries of sustainable aerospace manufacturing.

Industry leaders believe the impact will extend well beyond Sweden. By enabling lighter, more efficient engines, the technology has the potential to reduce fuel consumption and emissions across the aviation sector. Furthermore, the ability to redesign components from the ground up could reshape supply chains, creating opportunities for new efficiencies in aircraft production worldwide.

The Centre of Excellence is expected to position Sweden at the forefront of aerospace innovation, combining industrial expertise with government-backed sustainability goals. It also highlights the growing role of advanced manufacturing technologies in meeting global climate targets, particularly in sectors as challenging to decarbonise as aviation.

Firefly Aerospace has taken a significant step toward launching rockets from Europe, thanks to a newly signed Technology Security Agreement (TSA) between the United States and Sweden. This agreement authorizes the export and launch of U.S. rocket technology from Swedish territory—an essential requirement for any American aerospace company operating internationally due to strict regulations tied to national security.

With this agreement, Sweden joins a small group of countries—including the United Kingdom and Australia—that have met the stringent requirements set by the U.S. for hosting American orbital launches. The signing of the TSA took place on June 20 at the Swedish Embassy in Washington, symbolizing a deepening of bilateral cooperation in the space sector.

For Firefly Aerospace, the TSA clears a critical regulatory hurdle and unlocks new opportunities in the European space launch market. The company plans to launch its Alpha rockets from the Esrange Space Center in northern Sweden, a site operated by the Swedish Space Corporation (SSC). The facility is already equipped with key infrastructure, including a launch control center, telemetry systems, and tracking radars, positioning it as a strategic hub for European orbital missions.

Firefly’s first launch from Esrange is targeted for 2026. This move represents more than just geographic expansion—it’s a strategic play to serve the growing demand for satellite launches across Europe. With Esrange, Firefly aims to provide a reliable, regional solution for commercial and government satellite operators looking to avoid the congestion and scheduling bottlenecks that plague many U.S. launch sites.

"Finalization of the TSA gets us one step closer to launching our Alpha rocket from Sweden and filling a void for the European satellite market," said Adam Oakes, Firefly’s vice president of launch operations. He emphasized that the agreement not only removes regulatory barriers but also provides confidence to customers that both the U.S. and Sweden are fully committed to supporting orbital launch capabilities from Esrange.

The company has expressed interest in maintaining multiple launch sites globally, including Wallops Island in Virginia. This diversification is designed to reduce reliance on its current primary launch site at Vandenberg Space Force Base in California, which often experiences heavy traffic from multiple commercial and government missions.

Despite the momentum, Firefly is also managing recent challenges. In April, a launch of the Alpha rocket ended in failure when the upper stage engine nozzle was damaged during flight. The vehicle failed to reach orbital velocity, and both the rocket and its payload—a demonstration satellite—were lost over the ocean. The company has not yet released the findings of its investigation or indicated whether this incident will delay its planned expansion to Sweden.

Even so, the new TSA marks a turning point for Firefly. It opens the door not just for launches from Sweden, but for broader transatlantic collaboration in the space industry. With the European market in need of dependable launch providers—and geopolitical tensions driving interest in secure, non-Russian access to space—Firefly’s move into Sweden could prove both timely and transformative.

Hanwha Aerospace to Establish Missile Manufacturing Plant in Germany as European Expansion Accelerates

Hanwha Aerospace Co., South Korea’s leading defense manufacturer, is set to build a precision missile production facility in Germany, marking a key step in its strategy to expand across the fast-growing European defense market.

The move reflects the company’s broader ambition to establish a strong industrial presence in Europe, driven by the region’s historic levels of defense spending and its strategic shift toward localizing arms production.

At a recent investor and stakeholder briefing in Berlin, Hanwha’s European subsidiary announced plans to scout multiple sites in eastern Germany for its first manufacturing plant in the country. Sources familiar with the matter said this marks the first time the company has publicly confirmed plans for a German production base.

Over 100 representatives from German government agencies and defense industry partners attended the event.

Historically, Hanwha relied on German technology to power its flagship K9 self-propelled howitzer. That dependency was reduced in 2023 after the company began using domestically produced engines from South Korea’s STX Engine Co., enabling smoother exports, especially to the Middle East.

The planned German plant will serve as a production hub for advanced weapons systems, including guided missiles and ammunition. Hanwha Aerospace has already partnered with more than 60 German suppliers and plans to pursue joint R&D initiatives, develop integrated supply chains, and invest in local talent.

“We are committed to building cutting-edge defense capabilities in close cooperation with our German partners,” said Bae Jin-kyu, head of Hanwha Aerospace’s European operations.

Germany is a centerpiece in Hanwha’s broader European strategy, which also includes projects in Poland and Romania. In Poland, Hanwha has formed a joint venture with WB Group to manufacture Chunmoo rocket launchers and guided missiles. In Romania, the company has selected a site for a new plant to produce K9 howitzers and K10 ammunition resupply vehicles, with construction expected to begin this year and operations starting by 2027.

In July 2024, Hanwha signed a 1.4 trillion won ($1 billion) deal with Romania to supply 54 K9 howitzers and 36 K10 ARVs. These systems are powered by engines from MTU Aero Engines and transmissions from Renk Group AG—both German companies.

Previously, Hanwha’s reliance on German technology hindered its global ambitions. In 2020, the company had to withdraw from a major K9 export deal with the United Arab Emirates after Berlin blocked arms sales to the Middle East.

Now, Hanwha’s German expansion aligns closely with the European Union’s push for defense self-sufficiency. In May, the European Commission announced a €800 billion ($903 billion) defense industry strategy through 2030, prioritizing European-made military systems.

To support its global growth, Hanwha Aerospace plans to finance its overseas ventures through a 2.3 trillion won rights offering announced in April. About 1.6 trillion won will be allocated to international defense projects, the company said.

The Rise of Proton Exchange Membrane Fuel Cells — And the Growing Need for Control System Experts in China

As nations intensify efforts to combat climate change, the global spotlight is increasingly focused on hydrogen as a clean energy carrier — and Proton Exchange Membrane (PEM) fuel cells are emerging as a leading technology in this transition. With high energy efficiency, scalability, and zero emissions at the point of use, PEM fuel cells are seeing growing adoption across transportation, industrial, and energy sectors.

In particular, China is becoming a major hub for PEM fuel cell development, creating an urgent and rapidly expanding demand for specialized talent — especially Fuel Cell Control Experts.

What Are PEM Fuel Cells and Why Do They Matter?

Proton Exchange Membrane (also called Polymer Electrolyte Membrane) fuel cells generate electricity through an electrochemical reaction between hydrogen and oxygen, producing only water and heat as byproducts. Unlike combustion engines, PEM fuel cells operate silently, emit no pollutants, and offer a fast response to load changes, making them ideal for mobile and distributed energy applications.

They are especially suitable for:

Fuel cell vehicles (FCVs) — buses, trucks, and cars

Backup and off-grid power systems

Material handling equipment like forklifts

Portable and military power solutions

Why the Sector Is Booming

1. China’s Hydrogen Push

China has made hydrogen a strategic priority in its national energy strategy. Cities and provinces are rolling out ambitious hydrogen roadmaps, aiming to build thousands of hydrogen refueling stations and put tens of thousands of FCVs on the road by 2030.

This aligns with China’s dual goals of reducing urban air pollution and achieving carbon neutrality by 2060.

2. Government Incentives and Industrial Policy

Generous government subsidies, infrastructure investment, and joint ventures between domestic firms and global fuel cell companies have accelerated technology deployment and commercial adoption.

3. Decentralized Energy Systems

PEM fuel cells are being adopted beyond transportation, including in telecom towers, residential buildings, and emergency backup systems — all of which benefit from clean, quiet, and reliable energy.

The Critical Need for Fuel Cell Control Expertise

As PEM fuel cell systems become more widespread and complex, their performance, safety, and reliability hinge on advanced control systems.

Fuel Cell Control Experts are vital in the following ways:

System Optimization: They design and fine-tune the balance of plant (BoP) — including air supply, cooling, and hydrogen management.

Safety Management: They implement fault detection, thermal control, and pressure regulation to prevent system failure.

Software & Embedded Systems: Experts develop real-time control algorithms and integrate software with the fuel cell stack, vehicle systems, or grid interfaces.

Diagnostics & Prognostics: Predictive maintenance and degradation modeling are crucial for system longevity and commercial viability.

As systems scale from lab prototypes to mass-market deployment, the sophistication of control architecture becomes a make-or-break factor.

Talent Gap and Industry Implications

Despite the urgency, there is a global shortage of professionals with deep experience in PEM fuel cell control — particularly in China, where demand has outpaced local training and expertise development. Many companies are:

Expanding internal training programs

Partnering with universities and research institutes

Recruiting internationally to fill knowledge gaps

The pressure to commercialize fuel cell vehicles and infrastructure within tight policy timelines is intensifying the need for skilled engineers, especially those with cross-disciplinary knowledge in electrochemistry, control systems, embedded hardware, and software integration.

What’s Next?

As the energy transition accelerates, PEM fuel cell control experts are becoming indispensable across industries. Their work not only ensures system safety and efficiency but also enables scalability — which is critical for widespread adoption.

In the coming years, we can expect:

Increased international collaboration to address talent shortages

Growing investment in education and upskilling programs

More career opportunities in hydrogen hubs like China, Germany, Japan, and the U.S.

Proton Exchange Membrane fuel cells are no longer emerging tech — they’re becoming a core component of the clean energy landscape. As China and other major economies push forward with hydrogen infrastructure and fuel cell vehicle deployment, the demand for control system expertise will only intensify.

For engineers, researchers, and technologists, now is the time to engage. The future of clean energy will be shaped not only by chemistry and hardware — but by the software and control systems that make PEM fuel cells run safely, efficiently, and at scale.

If you are a specialist in this field and looking to make a meaningful impact in the next phase of clean energy innovation, we invite you to explore current opportunities. Submit your CV for active roles in this sector at:https://www.icautochina.com/job-search/22-fuel-cell-sealing-expert-contract-job-china/senior-engineering-expat-contracts/baoding/job